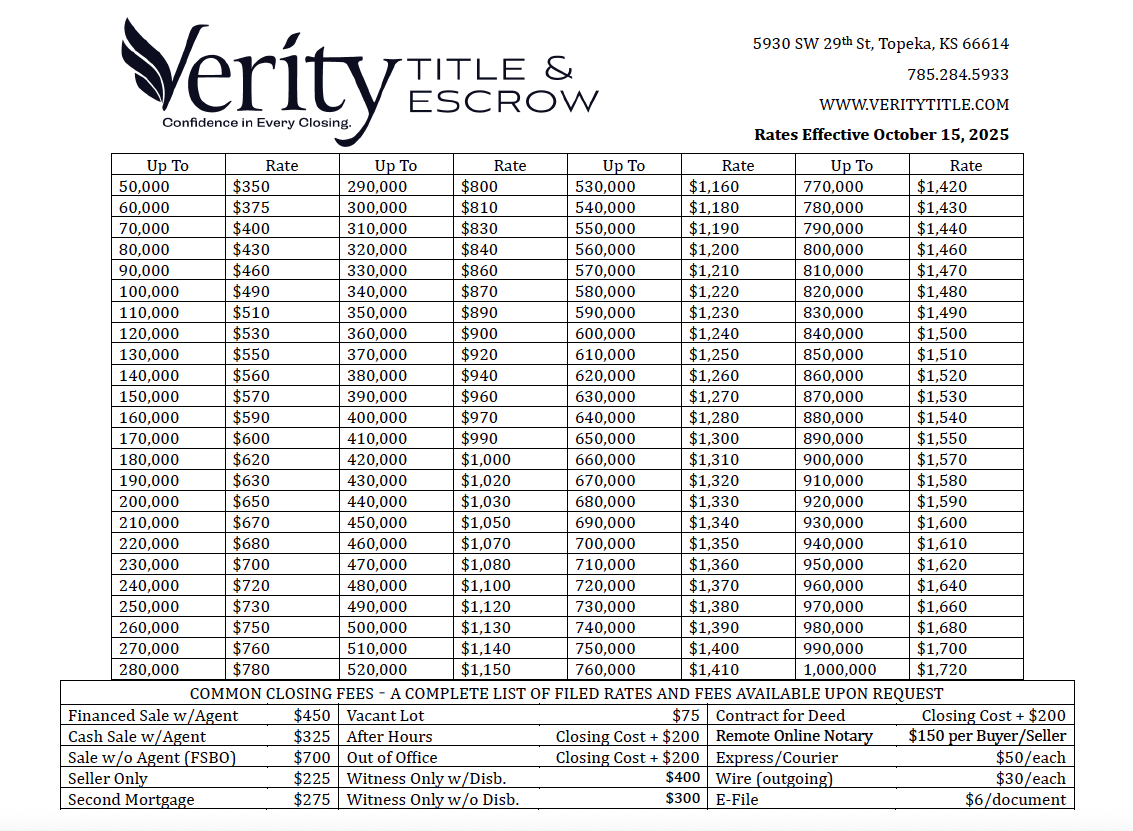

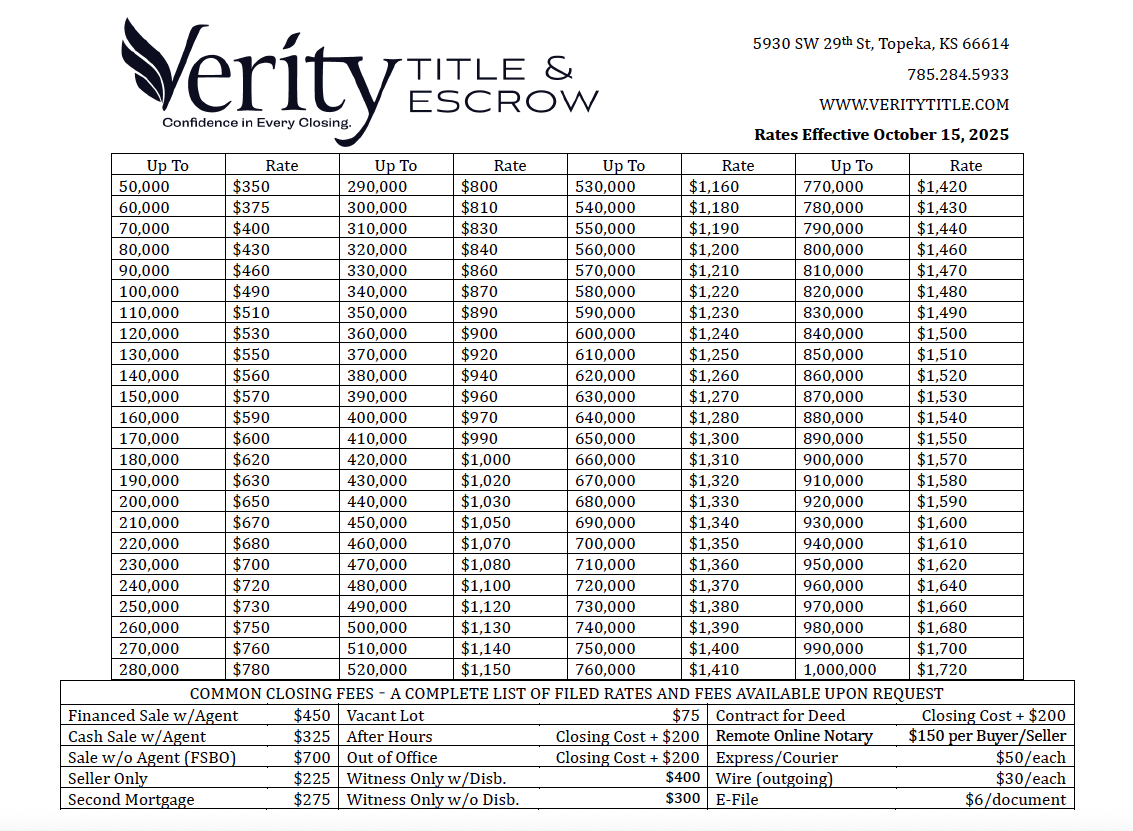

At Verity Title, we believe clarity builds confidence. Our goal is to make every part of the title and closing process simple, transparent, and easy to understand, including our pricing. This page serves as a resource for you to view or download our official Rate Sheet, outlining the current title insurance premiums, closing fees, and other related costs.

Whether you’re a realtor, lender, buyer, or seller, knowing what to expect up front helps everyone move forward with confidence.

All rates are compliant with state regulations and subject to change as filings are updated or approved.

Clear Communication

We explain every line item and ensure no surprises at closing.

Trusted Expertise

Our experienced team guides you through the title process with accuracy and care.

Local Knowledge

We understand the market and regulatory requirements across our service areas.

Client-First Approach

Every detail of your transaction is handled with integrity, precision, and respect.

If you’d like a personalized estimate for your upcoming transaction, our team is happy to help.

Contact us today for a detailed quote based on your property location, purchase price, and loan amount.

Buying a home or property is one of the biggest financial decisions you’ll make. While inspections, appraisals, and loan approvals get a lot of attention, one critical piece of the puzzle often gets overlooked: title insurance.

Buying a home is one of the most exciting milestones in life, but the closing process can feel complex and overwhelming. This guide breaks down what happens at closing, what you need to prepare, and how to ensure everything goes smoothly.

Closing day is the moment you’ve been waiting for—the day you officially become a homeowner. With so many documents, payments, and steps involved, it can feel overwhelming. This quick checklist will help you stay organized, avoid last-minute surprises, and close with confidence.

Closing day is the final step before you officially become a homeowner. While excitement is high, small missteps can lead to delays or complications. Here’s what not to do before signing day—and how to stay on track for a smooth closing.

Wire fraud has become one of the fastest-growing threats in real estate transactions. Scammers often target buyers during the closing process, sending fraudulent wiring instructions that can cost thousands of dollars—or even your entire down payment—if you aren’t vigilant.